Fica withholding calculator

Urgent energy conservation needed. A withholding tax is an income tax that a payer typically an employer remits on a payees behalf typically an employee.

Federal Income Tax Fit Percent Method How To Calculate Fit Using Percent Method Youtube

This calculator is a tool to estimate how much federal income tax will be withheld from your gross monthly check.

. Get the Latest Federal Tax Developments. Businesses impacted by recent may qualify for extensions tax relief and more. Ad Bloomberg Tax Expert Analysis Your Comprehensive Federal Tax Information Resource.

IR-2019-155 September 13 2019. Enter your info to see your take home pay. Social Security and Medicare Withholding Rates.

For earnings in 2022 this base is 147000. The total withheld is 765 of your gross pay unless additional Medicare taxes apply. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

See how your withholding affects your refund take-home pay or tax due. Since the rates are the same for employers and employees once youve calculated the employees contribution you know the employer portion as well. Hourly Salary - SmartAsset SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes.

The payer deducts or withholds the tax from the payees income. And so if youre self-employed you dont have to pay FICA on all your salary just on 9235 of it 9235 being 100 minus 765 - which is the contribution that your employer would have paid if you had an employer which you dont. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. The wage base limit is the maximum wage thats subject to the tax for that year. This is a projection based on information you provide.

The mobile-friendly Tax Withholding Estimator. This is tax withholding. If the employee earns 147000 prior to the end of the year the employee no longer pays into FICA theyve capped out their benefit earnings.

Occupational Disability and Occupational Death Benefits are non-taxable. Use this tool to estimate the federal income tax you want your employer to withhold from your paycheck. How It Works Use this.

These taxes include 124 percent of compensation in Social Security taxes and 29 percent of salary in Medicare taxes totaling 153 percent of each paycheck. 2022 Federal Tax Withholding Calculator. Raise your AC to 78 from 3pm - 10pm.

Free step-by-step webinar September 19. If you are married but would like to withhold at the. Only the social security tax has a wage base limit.

The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your employer. Earnings Withholding Calculator. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

However if the employee earns in excess of 200000 a new Medicare tax is at that point applied to their gross earnings. WASHINGTON The new Tax Withholding Estimator launched last month on IRSgov includes user-friendly features designed to help retirees quickly and easily figure the right amount of tax to be taken out of their pension payments. The employer also pays 145 with no limit but they dont pay any additional tax.

The Federal Insurance Contributions Act FICA is a federal law that requires employers to withhold three different types of employment taxes from their employees paychecks. You can use the Tax Withholding Estimator to estimate your 2020 income tax. Please visit our State of Emergency Tax Relief.

It is possible to have been overwithheld for OASDI FICA taxes in the event that the total of all W2 earning from multiple employers for the year 2022 exceed 113700. Over a decade of business plan writing experience spanning over 400 industries. These tax calculations assume that you have all earnings from a single employer.

The Medicare withholding rate is gross pay times 145 although high-income individuals will pay an additional 09.

Federal Income Tax Fit Payroll Tax Calculation Youtube

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Fica Taxes For Employee Youtube

How To Calculate Payroll Taxes Methods Examples More

How To Calculate 2019 Federal Income Withhold Manually

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Federal Income Tax Rate Calculator Factory Sale 51 Off Www Wtashows Com

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

How To Calculate Federal Income Tax

Federal Tax Calculator Hot Sale 52 Off Www Wtashows Com

Federal Income Tax Calculator Flash Sales 57 Off Www Wtashows Com

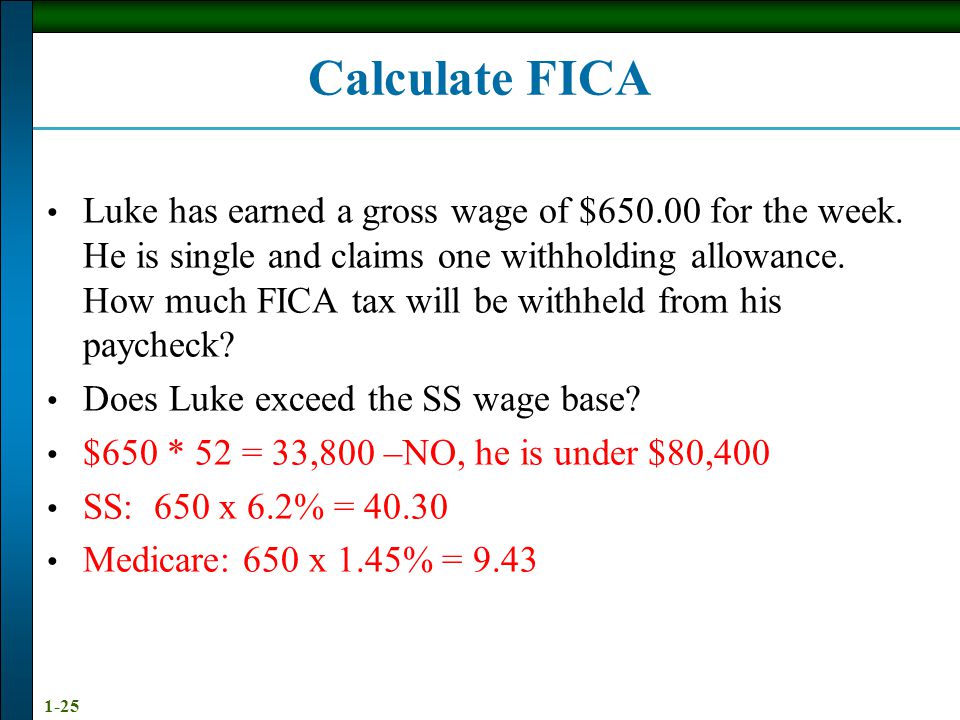

Chapter 9 Payroll Mcgraw Hill Irwin Ppt Download

Easiest 2021 Fica Tax Calculator

Paycheck Calculator Take Home Pay Calculator

Tax Withheld Calculator Shop 57 Off Www Wtashows Com

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate Federal Withholding Tax Youtube